🏎️ Formula 1 Group: Pole position in the business of high-speed spectacle 🏁

Company presentation

Liberty Media Formula One Group (FWONA) is a subsidiary of Liberty Media Corporation and owns the commercial rights to the prestigious Formula One World Championship, arguably the most famous motorsport series in the world. The Group is listed on NASDAQ under the ticker symbols FWONA (Series A) and FWONK (Series C), representing the opportunity for shareholders to benefit from one of the most valuable sports franchises.

Historical development

Liberty Media acquired Formula 1 from CVC Capital Partners in 2017 for 4.4 billion US dollars. Since then, the company has undergone a profound modernization of the motorsport series with the aim of reaching a broader audience and repositioning the sport in the digital era. The most significant changes include an increased focus on social media presence, new formats and a broader international expansion.

Business model

The Formula One Group's business model is based on several solid sources of income:

1. broadcasting rights: the sale of TV rights represents the largest share of revenue and makes it possible to make Formula One accessible to a wide audience worldwide.

2. race organizer fees: Venues pay substantial sums to be part of the Formula 1 calendar as these events provide both economic and tourism incentives.

3. sponsorship and advertising: Major companies from various industries use the global reach of Formula 1 to showcase their brands.

4. hospitality and VIP packages: Exclusive experiences at the race tracks and customized VIP offers are a lucrative source of revenue.

5. merchandising: The sale of fan merchandise is a growing area, particularly due to the expansion of e-commerce and the increasing popularity of Formula 1 in new markets.

Core competencies and future prospects

The outstanding core competence of the Formula One Group lies in the organization and marketing of motorsport events at the highest level. Formula 1 attracts millions of spectators every year, both locally and worldwide via television and digital platforms.

The company is focusing on the following areas for the future:

1. digitalization and social media: With initiatives such as the popular Netflix series Drive to Survive, Formula 1 has tapped into new target groups and appealed to a broader, younger audience.

2. sustainability and environmental protection: Liberty Media plans to make Formula 1 climate-neutral by 2030 and is therefore promoting technical innovations such as sustainable fuels and more energy-efficient drive technologies.

3. expansion into new markets: The USA in particular has proven to be an up-and-coming market, supported by the introduction of new racetracks such as Miami and Las Vegas. This strengthens the global growth of the brand and opens up new commercial opportunities. MotoGP is currently being taken over in order to achieve similar success to Formula 1. This opens up enormous growth opportunities. If these plans are successfully implemented, another racing series could be taken over in the next four to five years.

Strategic initiatives

Liberty Media has taken several strategic measures to further drive the growth of Formula 1:

Cost capping for teams: this measure is designed to make the competitive environment fairer while ensuring the financial stability of the teams.

New race tracks: The addition of high-profile locations such as Miami and Las Vegas is aimed at strengthening the global presence and opening up new markets.

Focus on digital content: The expansion of streaming offerings and digital experiences will allow Formula 1 to tap into new revenue streams and build a deeper connection with fans.

Market position and competition

Formula 1 is undisputedly the world's leading motorsport series, both in terms of its global reach and its economic influence. Nevertheless, the series is facing increasing competition, particularly from other motorsport series such as IndyCar and NASCAR in the USA, which are fighting for spectators and sponsors. At the same time, Formula 1 also competes on a global level with other popular sports vying for viewers' limited time budgets.

Total Addressable Market (TAM)

1. global TV audience: It is estimated that more than 1.5 billion viewers watch the Formula 1 season across various channels, giving the series immense reach and advertising opportunities.

2. on-site race attendance: The large numbers of spectators at the circuits themselves also contribute significantly to revenue, particularly through the sale of VIP tickets and hospitality packages.

3. merchandising: The sale of fan merchandise and the growing popularity of Formula 1-related products, including e-sports and gaming, open up additional revenue potential.

4. digital platforms and gaming: The increasing shift to the digital space and the emergence of e-sports offer new growth areas for Formula 1.

Share performance

Since the takeover by Liberty Media, Formula One Group shares have performed impressively. Over the last five years, the share has a TR of 91%. Since the beginning of 2024, the return is +17.6%, underlining the company's robust market position and growth potential. Despite occasional fluctuations, the long-term outlook for the Formula One Group remains promising.

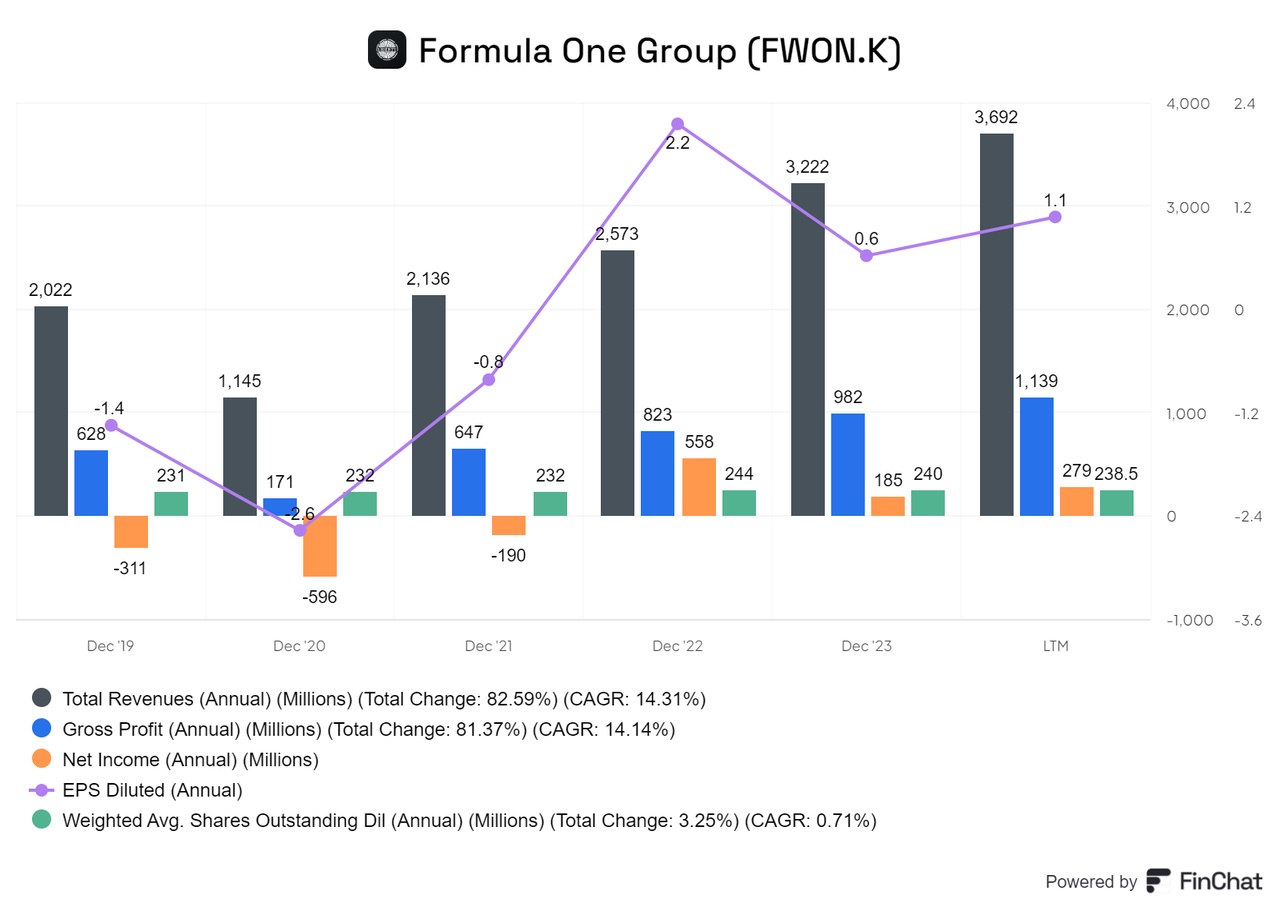

Development

The development is extremely positive and sales will more than double in the coming years compared to 2019. Net income has been stable in positive territory since 2022 and earnings per share (EPS) have also increased significantly, while the number of shares in circulation has only changed moderately. Although there was a new dilution due to the acquisition of MotoGP, this is rather small compared to the valuable asset gained here.

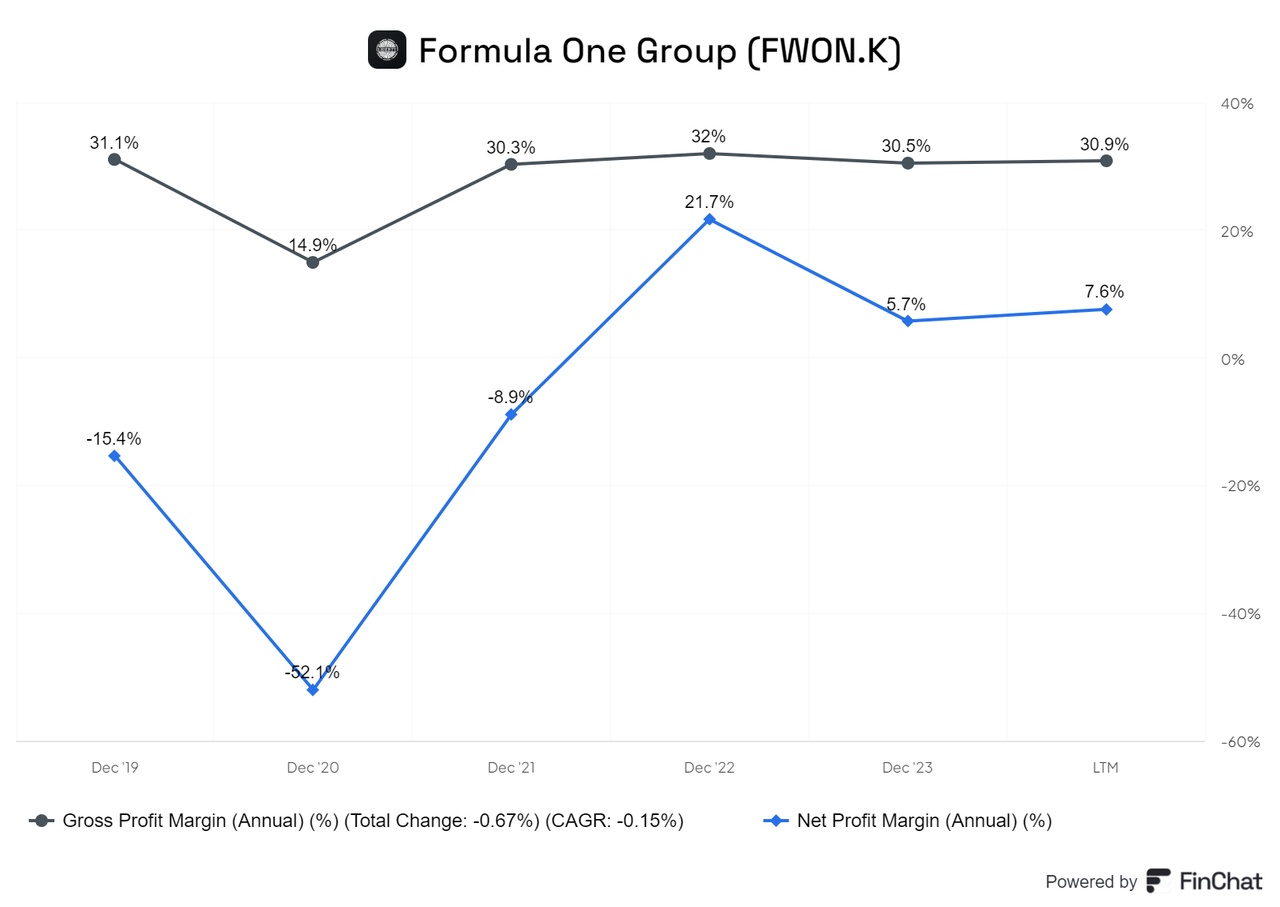

There is still potential for improvement in gross and net profit, but we have succeeded in increasing and stabilizing these key figures for the first time. A slow but steady increase is expected in the coming years. The synergies from the MotoGP takeover should further promote this trend and lead to a further long-term improvement.

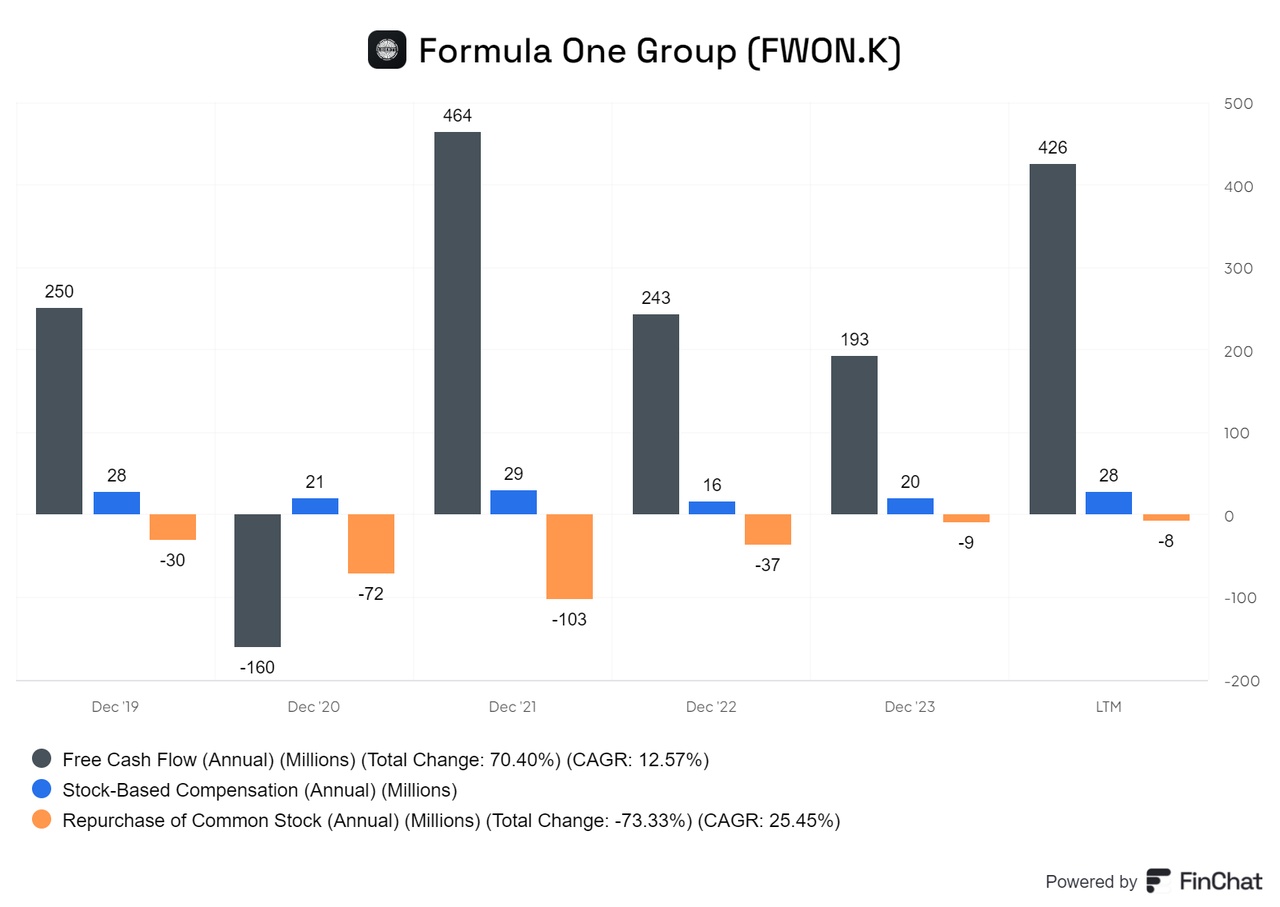

The free cash flow (FCF) is positive and the share remuneration remains at an appropriate level. In addition, shares are being bought back in moderate quantities, which reduces the dilution of shareholders.

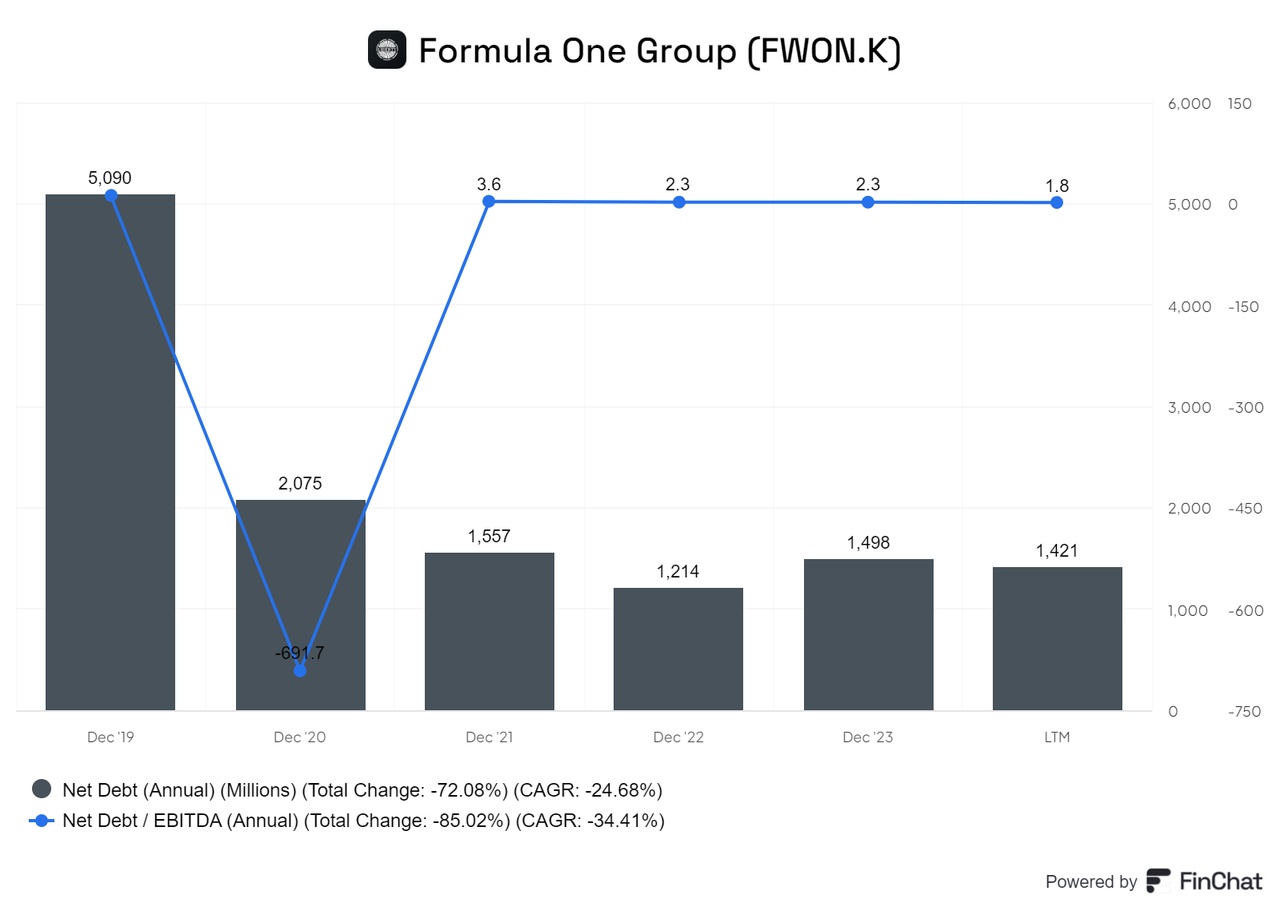

The ratio of net debt to EBITDA is below 3 and will increase slightly, but this is not a major concern. In general, there is a trend towards a reduction in net debt, which should be maintained after the takeover.

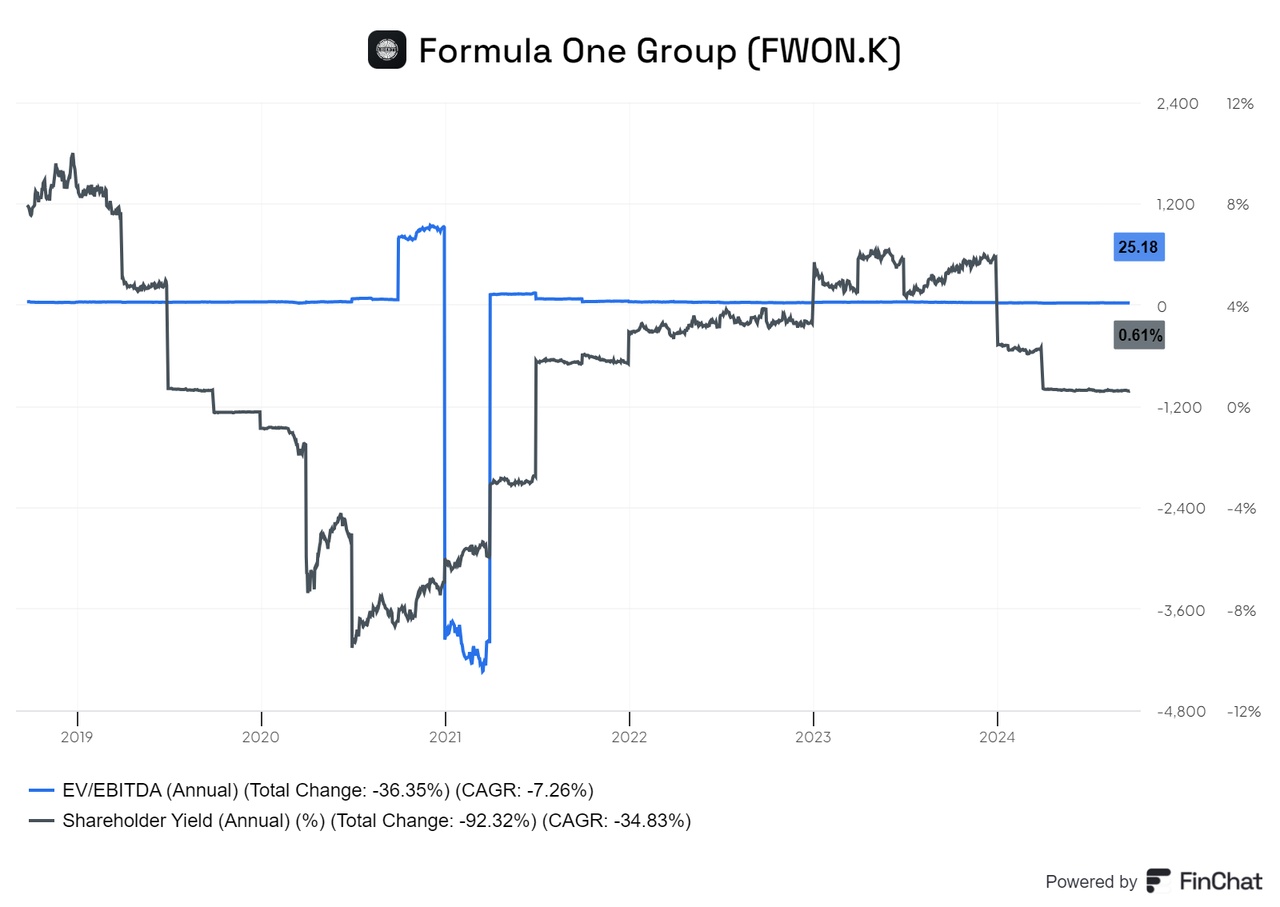

The shareholder return is currently low, but should rise again in the coming years. With an EV/EBITDA ratio of 25, the company has a decent valuation, which indicates that investors continue to expect significant growth. It is to be expected that the value will initially rise before falling again.

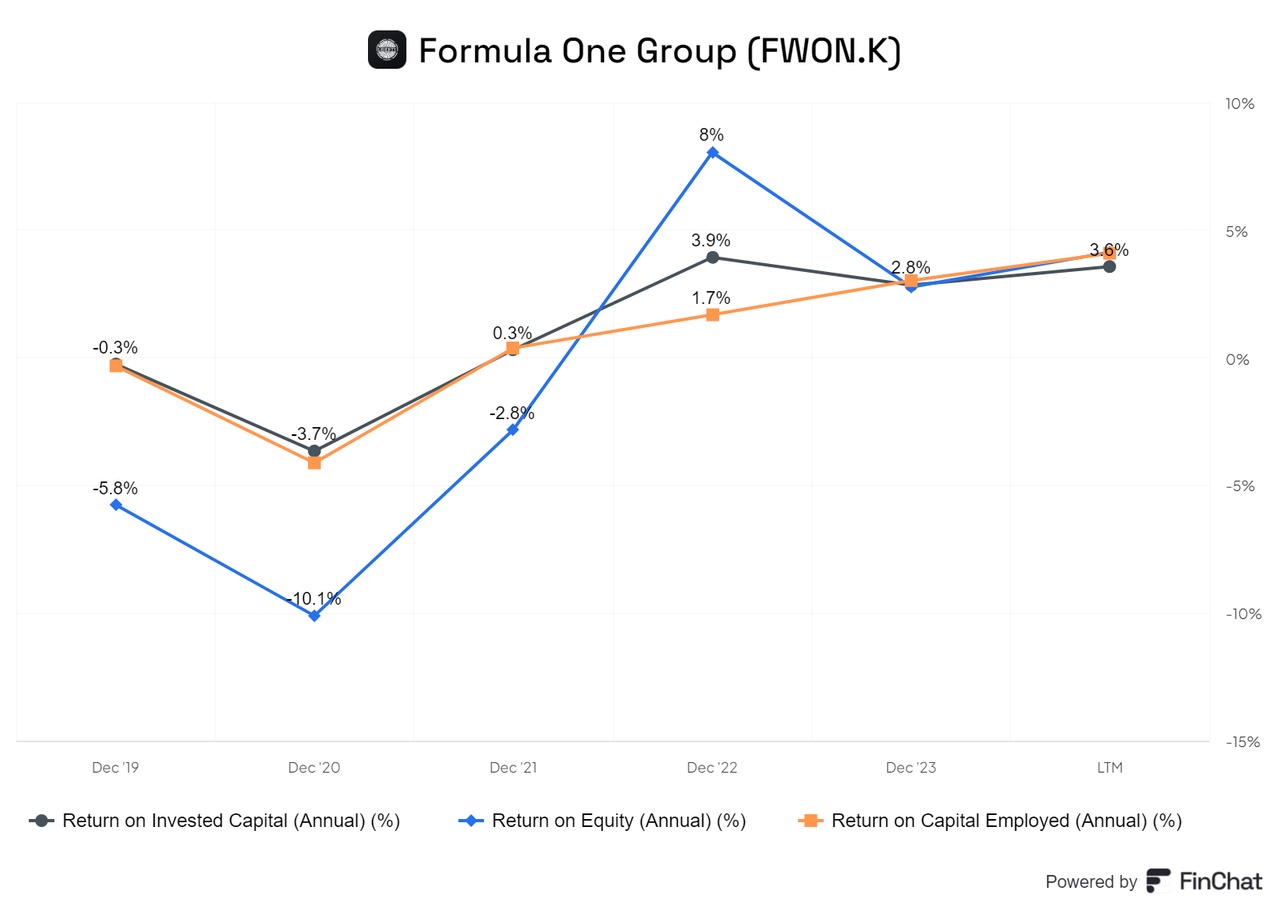

Capital efficiency currently looks like it could be improved, but will improve over time. As soon as more synergies are released and more efficient business strategies are implemented, the values should rise into the 10% range over the next few years. This is supported by the overall growing development, which is continuously pointing upwards. However, a little patience is required here.

Conclusion

It is somewhat difficult to compare the valuation of the company, as there are only a few sports leagues on the stock exchange and these are usually only represented in the portfolios of other companies. What is striking, however, is the positive history in which Formula 1 has been successfully developed. Not only has it been significantly improved, but it has also been made more lucrative and brought closer to the community through social media.

However, there is still a lot of potential, especially in Formula 2 and Formula 3, which are currently only moderately maintained. There is an opportunity to grow considerably here. The takeover of MotoGP opens up an exciting new perspective that makes it possible to use existing experience and better implement the sport in the USA.

Growth is therefore a given and the strategy is clearly communicated. It is difficult to judge whether one would be paying too much at any given time, but as a fan of Formula 1, I am happy to be involved in this story, which has not yielded poor returns so far and looks promising for the future. The key question for me is not whether I should get in, but at what price. In my opinion, an entry price between 56 and 58 euros would be okay, while 50 to 56 euros is considered good.