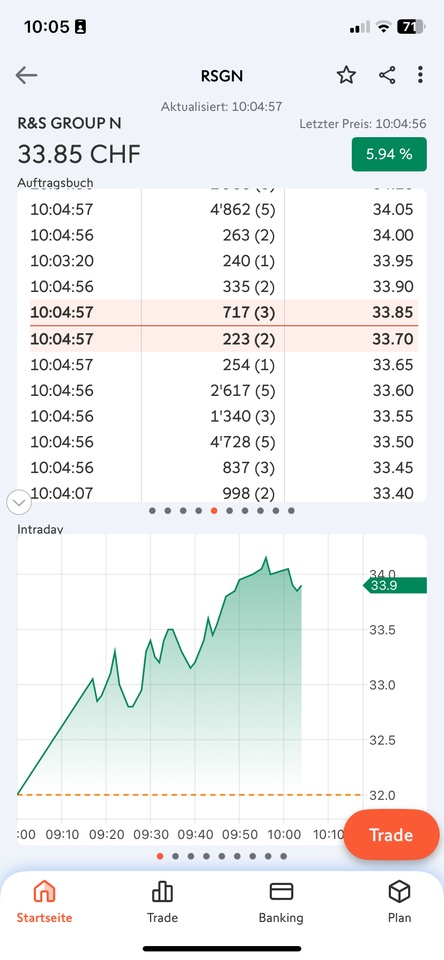

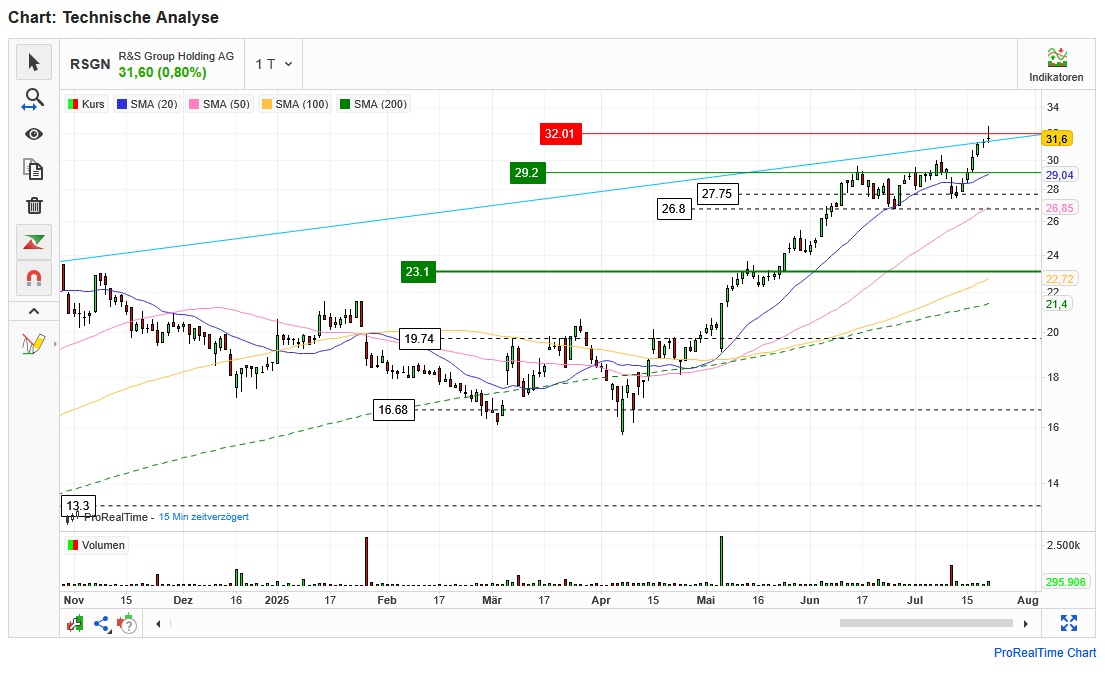

Zurich (awp) - Shares in the R&S Group soared on Tuesday following the key figures for 2025. The Basel-based transformer manufacturer has significantly increased sales and order intake and expects an EBITDA margin of slightly over 20 percent, and thus a margin at the upper end of the target range.

At around 9.45 a.m., the shares climb 17.5 percent to 19.44 Swiss francs. The share has thus broken out of the sideways trend that began in November. However, there is still a long way to go to the August high of 40.70 francs. The overall market as measured by the SPI is up 0.4 percent.

In an initial reaction, Octavian raises its rating for the shares to "buy" from "hold". According to the analysts, the margin indicates where things could go in 2026. And they see even greater growth opportunities for 2027.

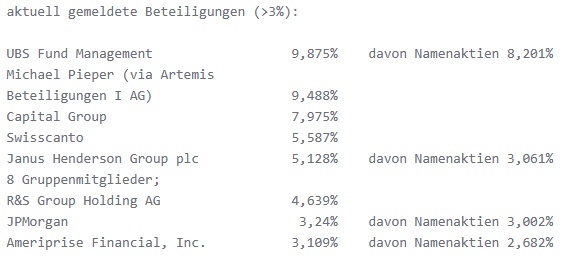

At UBS, the relevant expert also praises the margin development, even if the somewhat declining organic sales growth in the second half of the year could be viewed negatively.

ZKB sees the above-consensus order intake in particular as a "very good sign". According to analyst Florian Sager, R&S's EBITDA margin is also almost 100 basis points above the company's own estimates. One sticking point is the shortage of skilled workers at utility companies, which are an important customer group for R&S. The expert is hoping for further news with the earnings figures at the beginning of March.

Will continue to hold, dividend is also juicy. ❤️

(PS: Pretty much in the shot, so igr doesn't hear much from me right now, sorry <3)