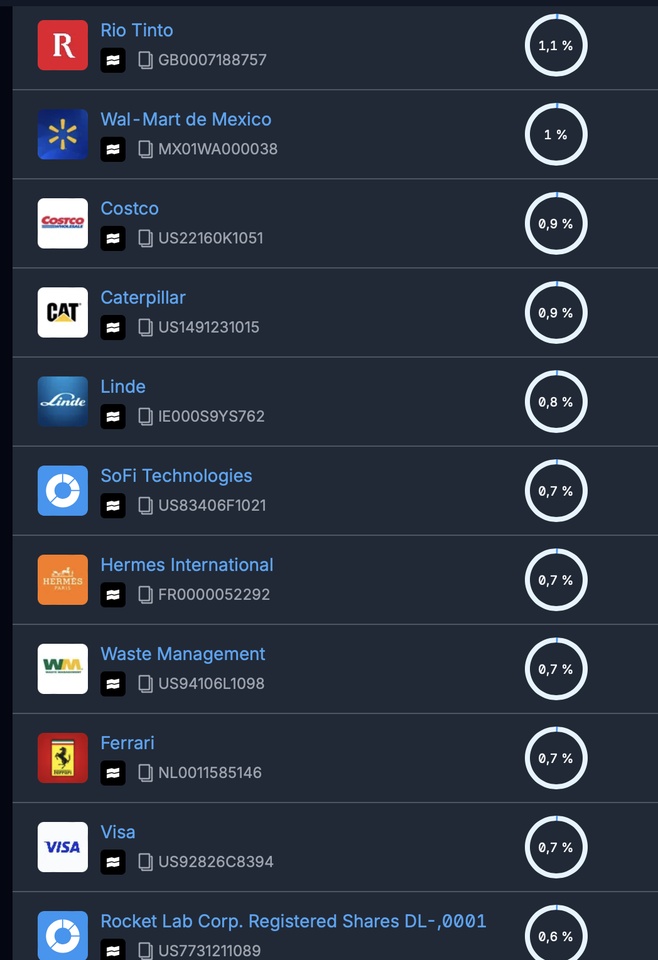

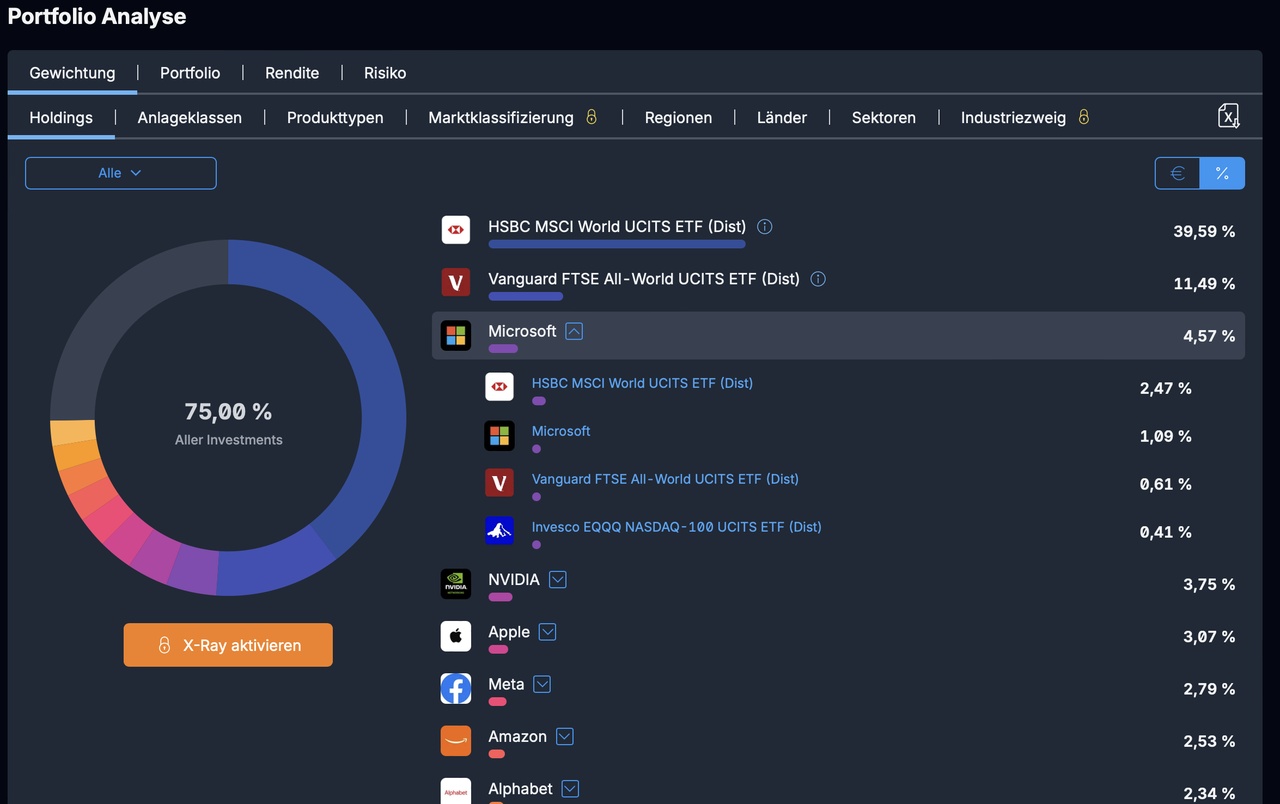

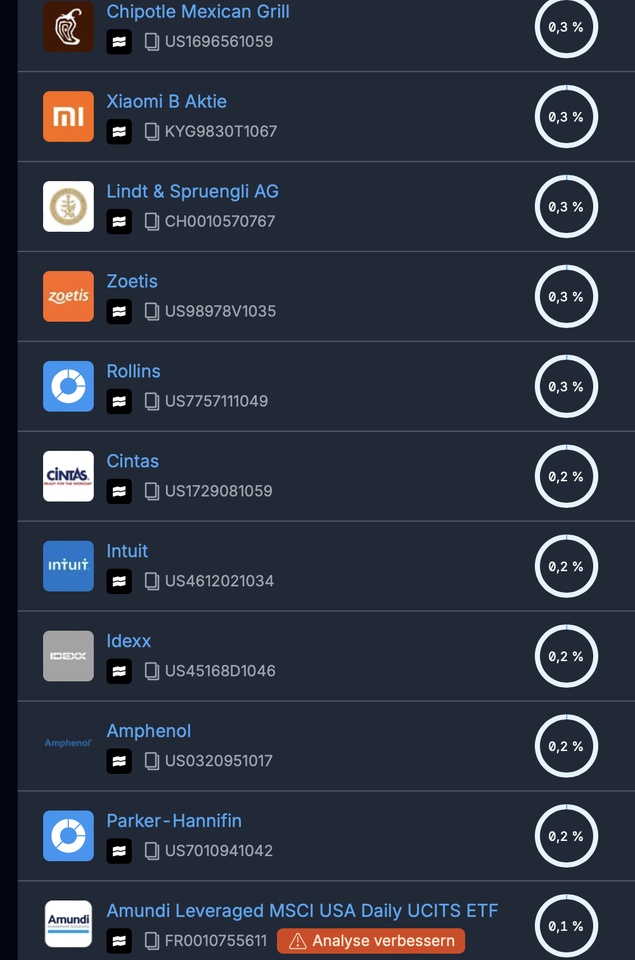

I would prefer to sell everything and put it into say 3-5 ETFs, but due to a mixture of different feelings I can't take this step. At least not overnight. Today I was able to part with the following positions (a big step for me, a small step for my portfolio).

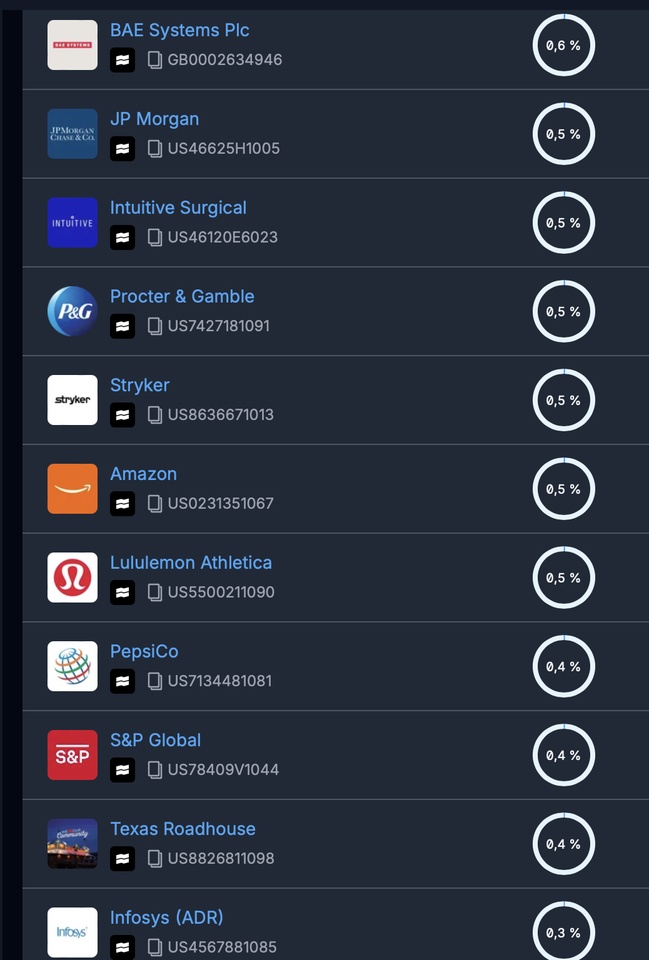

$COST (-0.56%) -3% may not have been the best time to sell, but I'm no longer convinced in the long term, or rather it doesn't fit my investment idea

$PG (-0.47%) -8% stinks of opportunity cost. It may be that there is a good entry point for a solid dividend stock at the moment, but I would rather continue to build up the broadly diversified ETF.

$ROL (+1.25%) -4% ditch or not, we won't see the big fast percentages here.

$RMS (-1.31%) +25% I would not buy again today at the current price and find the valuation excessively high.

Reallocated to $VWRL (-0.28%) 🥱 and $EQQQ (-0.34%) 😎

(Thanks to a mini crash from 17:00, I also got a lot of shares)