$3350 (-2.84%)

$NBIS (-4.3%)

$CIFR (-2.52%)

$NOVO B (-1.14%)

Since I want to be absolutely transparent here and not always just share the positive purchases, I should also post my sales and gimmicks.

I sold to minimize the risk slightly $3350 (-2.84%) to have some capital free and because the $BTC (-4.58%) could not hold the 100,000 $.

I also have a lot of profits in the loss compensation pot to create clear transparency here too: 8,879.48 .

For the smaller positions in the portfolio such as $NBIS (-4.3%) or $CIFR (-2.52%) I could also pull the ripcord again at any time if I realize it might go a little lower or the sentiment changes. $IREN (-3.72%) And $SOFI (-1.86%) are my core positions, so nothing will change. Even with $HIMS (+3.43%) I see more opportunities to buy and $PATH (-2.37%) and $PRCT is holding up very well, I could double again today.

$NOVO B (-1.14%) and $UNH (-3.05%) are more cash positions, I find the valuations super attractive and am convinced that we have a super risk/opportunity potential here, but it can happen that I sacrifice parts of it in favor of tech if I see opportunities or get FOMO. 😊 (possibly also the whole position)

As quickly as it goes up, it can also go down again, be aware of your risk tolerance and don't let your emotions guide you, especially if you are an investor, short-term volatility is irrelevant. $IREN (-3.72%) can easily jump up again by 20-50% in the event of potential deals.

For anyone who finds this post annoying, just keep scrolling 😁, I just wanted to provide clarity for those people who might buy everything blindly, I think that's the way it should be.

Since I do everything from my cell phone and don't always have time to upload it right away, my purchases / sales don't always come right away and sometimes with a time delay.

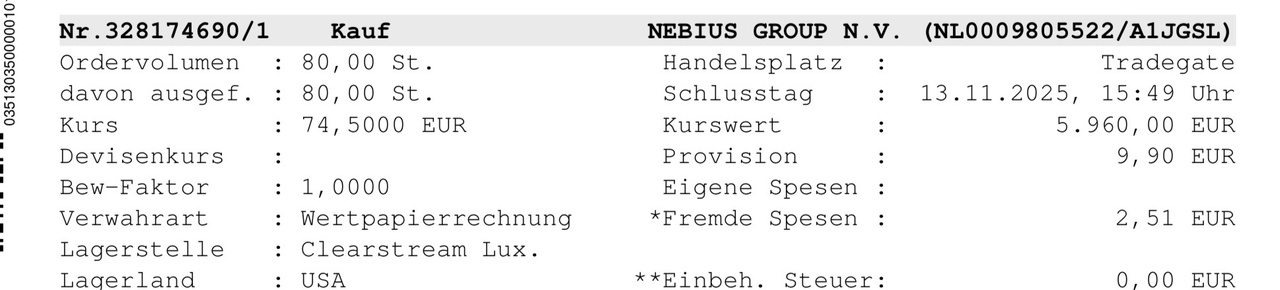

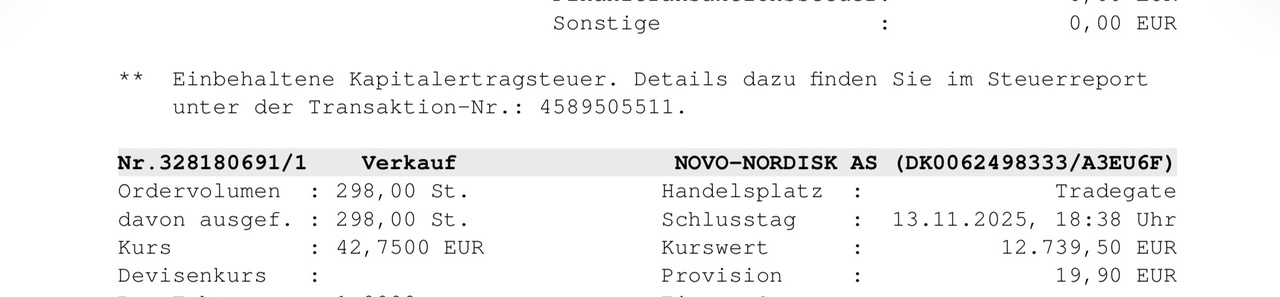

And to prove the authenticity of my portfolio for those who question it:

Here are a few explanations 🫡

Yes, fees could be lower, but in Austria as a tax-simple broker and to be able to buy almost any share, hardly any alternatives and I don't want to bother with Trade Republic 😊